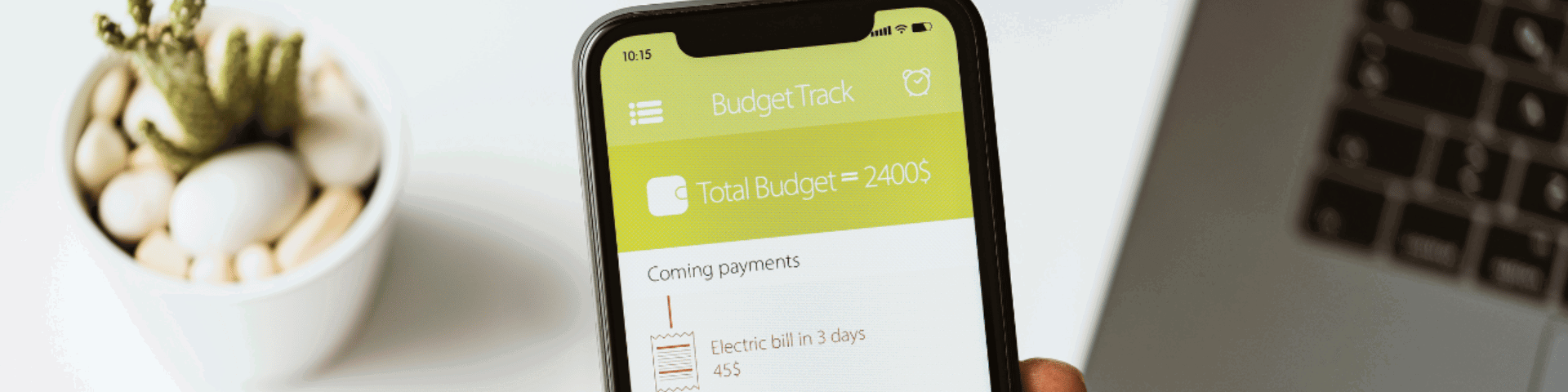

Budgeting tools

Budgeting is the first and most basic step to successful financial management. Everyone can benefit from having a budget, they’re not strictly for those struggling to make ends meet. In fact, the opposite is more likely true: people are less likely to struggle if they budget correctly. It’s a great way to stay ahead of the game by ensuring your hard-earned cash is being put in the right places.

A simple budget is built by adding up how much money we are bringing into the household and then adding up how much money we need to be spending. The keyword here is ‘need’. That’s all your utility bills and other necessary expenses like groceries (not eating out!), petrol or public transport costs, school supplies for your kids, etc.

Once you’ve got both numbers, it’s easy to see how much money you have leftover (surplus) or how much you’re short (deficit). The goal here is to create as much surplus as you can by reducing spending where possible. Surplus should firstly be used to pay off debts, and then save and invest towards your financial goals.

There are a range of free online budgeting tools in NZ, and many banks even offer their own versions.

Sorted Budgeting Tool

Sorted.org.nz’s budgeting planning tools are a free and easy way to get started budgeting correctly.

Westpac Budget Calculator

Westpac’s free budget calculator will help you assess your income and expenditure. It’ll help you create your own budget and compare your incomings and outgoings.

Pocketsmith

Take control of your money and look into the future of your finances with Pocketsmith, a comprehensive personal finance tool with a set of accounts & transactions, budgeting software tools and reporting dashboards. They even have a budget calendar to schedule your upcoming bills and budgets.

Honeydue

Finding it hard to budget with your partner? Honeydue is designed to help couples budget and manage their finances effectively together.

Expense tracking tools

As we now know from budgeting, the most important part of personal finance is managing your spending. If you struggle with spending, and especially if you run your own business, then having the best app to keep track of your expenses becomes a necessity. Or, if you are struggling with paying your bills or taking control of your debts, you could consider taking out a personal loan from Instant Finance to find some relief.

Mint

Mint, one of the most powerful budget planning tools, conveniently brings together all your financial accounts into a single platform. This free tool not only monitors your expenses but also tracks your cashflow and helps you see opportunities to save money.

Expensify

Expensify is the ultimate solution for those looking for the best app to keep track of expenses, receipts, travel expenses, and any other business expenses. Simply take photos of your receipts, and they’ll upload automatically to Expensify to track your spending.

ASB – Track My Spending

If you’re an ASB customer, you have access to the best online budget tools where you can easily track every penny and compare it with your budget allowance. With ASB’s Track My Spending, you can easily stay on top of your finances and identify trends in your expenses and income.

Financial education tools

If you’re eager to learn more about managing your money with financial budgeting software tools, then good on you! There are plenty of resources available online to help you educate yourself, and your family.

Pennybox

Raise your kids to be financially savvy with Pennybox, a free iPhone app. Let them pitch jobs to you for extra pocket money, and fill out requests to withdraw cash.

ANZ – MoneyMinded

It’s not an app, but ANZ has helped nearly 300,000 people worldwide improve their financial skills through MoneyMinded. MoneyMinded is an education program that helps people build financial skills, knowledge and confidence.

ASB – Getwise

ASB GetWise is an innovative New Zealand financial literacy programme for young children. Workshops are presented direct to children in schools by full-time world-class facilitators. You can register interest for your school on their website.

Further financial reading

BNZ – Be good with money

BNZ has a great blog full of information about personal finance and financial tools. If you’ve got some extra reading time, check it out.

Kiwibank – Managing finances

Kiwibank also have a bunch of great information on financial management free to read on their website. They also have a range of tools like mortgage and loan calculators.

Westpac – Managing your money

Westpac offer webinars, interactive games, and in-depth articles to help boost financial literacy.

Now that you’ve got a belt full of financial budgeting tools, it’s time to put them to use. Pick a couple that look helpful to you and start budgeting, tracking expenses, and saving money. The more effort you’re willing to put in to managing your finances, the more (money) you’ll get out of it!

If you need help with tracking your spending, check out our blog on Why it’s important to track your spending or get in touch with our friendly team at Instant Finance.