Our Loan Application Process – Bank Statements

How & why, we collect Bank Statements.

As part of our loan application process, we need copies of your most recent bank statements – the previous 3 months’ worth.

Why do we need Bank Statements?

As part of our responsible lending practices, and in line with the Credit Contracts and Consumer Finance Act, we require copies of your bank statements to:

- Verify your income and expenses.

- Assess affordability to ensure the loan is right for you.

How We Collect Your Bank Statements

We use a secure third-party service, Bank Statements by illion (an Experian company), to collect your bank statements quickly and safely. This service allows you to share your bank transaction history with us in just a few clicks—no printing, scanning, or emailing required.

How does it work?

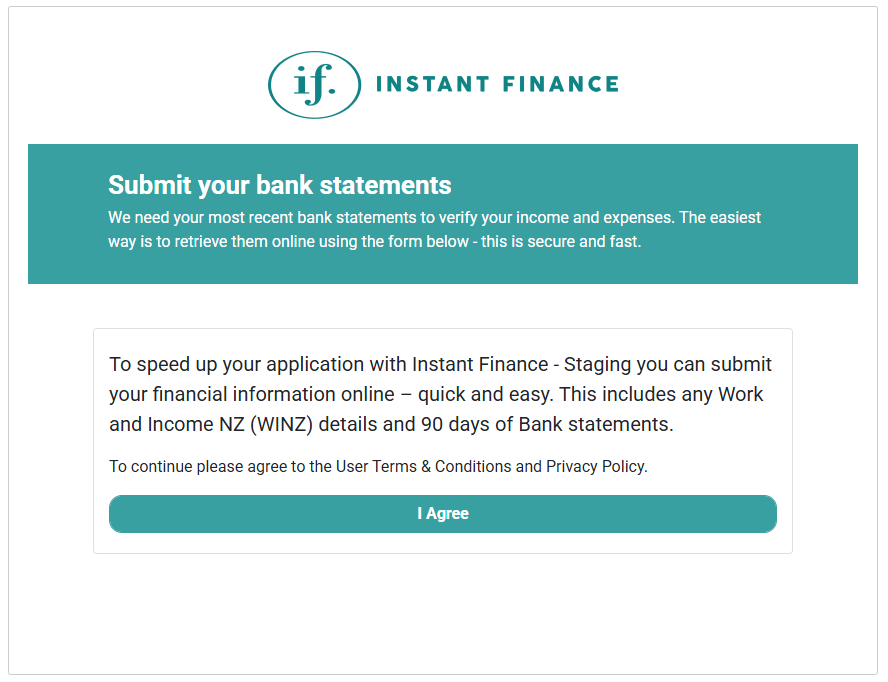

- We provide you with a secure link via our online application form, SMS or email.

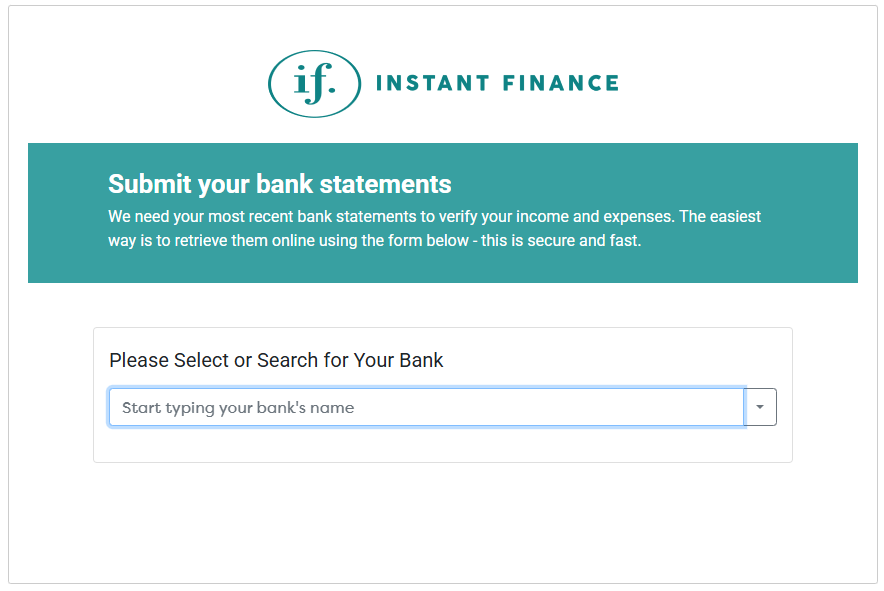

- You select your bank and then log in using your online banking credentials through the illion portal (if you have multiple banking relationships you will need to do this for each bank)

- Your statements are retrieved and sent directly to us in a secure format.

- We never see or store your login details—they are encrypted and never shared with Instant Finance.

- This process can also be used to provide information from WINZ/MSD

This process is fast, safe, and helps us assess your application more efficiently.